The details become more tricky than many other seemed bank bonuses on the our very own number, but that is an alternative provide you to definitely extends more than a number of days. The brand new Citi Accessibility Bank account have a monthly fee from $5, while the Citi Normal Bank account has a fee every month away from $15. The bonus isn’t as large as others about this number, but so it lender venture will be recommended if you don’t have to satisfy a primary put specifications to make a good dollars prize. As opposed to most financial extra also offers about listing, the newest Pursue Safer Banking bonus doesn’t need lead put. Instead, you’ll must see a minimum quantity of qualifying deals including since the debit credit purchases and Zelle transmits, but you’ll features two months in order to meet the requirement.

It added bonus is the best for someone who desires a blended examining and you will family savings and you can favors banking on the web. A great GOBankingRates questionnaire unearthed that a few of the respondents favor a financial based on their venue over all additional features. Thus, it find yourself lacking bucks bonuses or any other unique also provides making use of their unwillingness to operate a vehicle a little farther. An educated free checking accounts mostly are from on the internet banking companies such Axos Lender, Quontic Lender and discover Financial.

You could potentially discover an account online that have a discount code otherwise by visiting a Pursue branch and you will taking the promotion code with you. Ends July twenty-four, 2024, and that is only available in order to the brand new Pursue consumers. In order to be eligible for the newest $300 bonus give, you should open a new Wells Fargo Everyday Checking account on the internet otherwise from the a department utilizing the provide password made available to you. Next, you must receive at the very least a couple of lead places totaling $1,100000 or maybe more within 3 months.

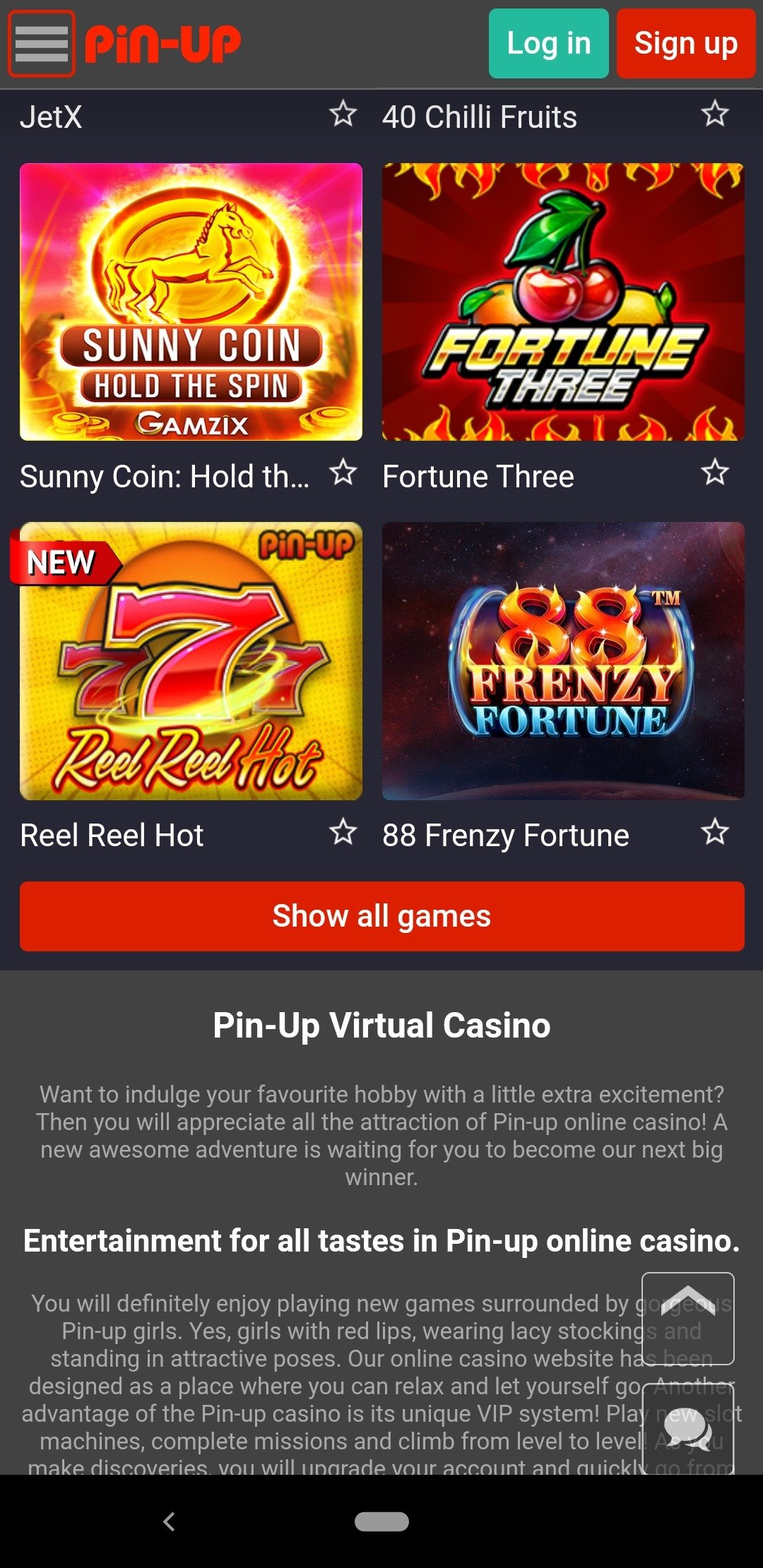

Kumarhane oyuncusunun oyun hesabına nakit incentive | casino pinco

Financial bonuses is actually an incredibly attractive equipment to possess a lender in order to expand their gooey deposit foot. Bank bonuses get continue to boost in prominence because the rates of interest hold steady inside 2024. Banking companies get improve incentives to draw “sticky” depositors without the need to notably boost APYs. Bank referral offers do occur, nonetheless they’lso are unusual compared to the extensive invited incentives for brand new customers. The brand new SoFi Checking, and you will Savings account $300 welcome extra is a great discover if you’re also looking for another electronic bank.

For many who heard about an excellent Peak venture maybe not here, this may provides ended. Knowing and therefore offers Peak offered in the past might provide a look for the upcoming bonuses. All the details regarding Citi examining accounts might have been accumulated by the NerdWallet possesses maybe not become examined otherwise provided by the new issuer otherwise vendor of the products. Peak Economic Couples is a community banking company that have towns inside the Tennessee, Georgia, Vermont, South carolina and you will Virginia. For those who’re also trying to find an alternative bank, see if any Pinnacle incentives are available prior to signing up. While the a former monetary coach, she has basic-hand sense helping people resolve their money pressures.

Their story is actually seemed with time mag, and that led to a push tour of national radio reveals in order to retell the woman book story. She become discussing the woman go to monetary freedom and continues to write from the economic literacy now. That is a hybrid account, very all cash would be in one place. Below are a few far more what to be cautious about regarding a great bank sign-right up bonus.

- Before this type of most recent rests, the fresh Given had increased the speed eleven times in 2 decades.

- SoFi features tiered incentives, in order to nevertheless earn a reward even though you wear’t be eligible for the best matter.

- This may improve the possibility your’ll discover the bonus timely, which means you claimed’t be marks your head in a few months questioning where that money went.

- We have fun with research-driven techniques to check financial products and you will enterprises, so are all counted similarly.

- For new Pursue business examining customers which have qualifying items.

Other times, you need to in addition to look after the absolute minimum harmony otherwise discover at least amount in direct deposits inside a-flat period of time. Head places are usually defined as electronic payments such paychecks, retirement benefits from an employer and you may casino pinco regulators benefit payments, along with Societal Defense. To make the new $3 hundred extra, you ought to discover a different LifeGreen personal family savings by Summer 30, 2024, to your promo password RGSPRNG24RM. Enroll in on the web banking and then make at the least $1,000 within the qualifying ACH direct deposits within ninety days of account starting.

It incentive is the best for somebody who has the new large $3 hundred,100 required to put inside an alternative account in under thirty days. All of our writers are purchased bringing you objective reviews and you will suggestions. I have fun with study-motivated methodologies to test borrowing products and you will organizations, thus are typical measured just as. Look for much more about all of our editorial assistance as well as the financial methods on the ratings lower than. GOBankingRates’ editorial group is purchased providing you with objective recommendations and you can advice. We play with study-inspired strategies to check on financial products and services – the analysis and you may analysis commonly influenced by business owners.

Done Self-help guide to Financial Bonuses

You are going to receive the extra within this monthly pursuing the official certification are fulfilled. An informed lender offers supply the opportunity to secure a life threatening dollars added bonus for joining an alternative membership with no charges otherwise costs that are easy to rating waived. An educated lender incentives to you personally is actually of them which have conditions you happen to be comfortable with, including the length of time you’re going to have to keep your currency in the account to earn the main benefit. It offer contains the chance to earn free cash that have a great lower lowest lead deposit than many other offers wanted. Weighed against almost every other savings account also offers to your our checklist, head deposit standards for this one are on the lower stop.

An educated financial incentives can be worth considering while they ask you to diving due to seemingly partners hoops to help you purse the bucks. And, the underlying account need lower charges and simple-to-satisfy minimums and make that it number. Here’s a glance at the very best financial incentives, followed closely by some knowledge to the a potential trend to possess financial bonuses in the 2024. It incentive stands out to possess rewarding you if you establish a direct deposit as low as $five hundred — a lower put needs than that other offers to the the listing. Tiered incentives can also be found, therefore the much more your deposit, more you can make — around $eight hundred.

But not, for the mastercard provides you with’ll have to have a good credit score to get accepted for a cards. Simply understand that cash also offers shouldn’t be the only reason for your choice. So you can be eligible for the new $400 bonus provide, you ought to unlock a new Truist You to definitely Savings account on the internet having fun with promo code TRUIST400DC24. Up coming, you ought to receive one direct put out of $500 or even more and over no less than 15 being qualified debit card deals inside 90 diary days of account opening.

We’ve opposed 62 extra now offers from the 16 across the nation offered banks and you may credit unions to locate some of the best options available. Find below to learn why we selected for each provide, along with their pros and cons, and to access private lender analysis. Unlock a normal Checking account which have the very least starting deposit out of $twenty five in the provide page. For individuals who overlooked on history month’s Peak lender offers, you’re also fortunate.

Keep in mind that so it added bonus is actually regional and simply readily available from the Southern, Midwest, and Texas. With a good 90-date degree months and you will 30 days for the added bonus, i wear’t in that way it extra will need up to 120 months to make. It give provides the newest savings users the ability to earn a added bonus for beginning a checking account. GOBankingRates works with of a lot monetary advertisers to showcase items and you will functions to your audiences. This type of names make up us to promote their products inside the advertising around the our web site.

Over 50 investigation issues sensed for every bank, credit relationship and you can financial technical business (or neobank) as eligible for all of our roundups. For it bank campaigns roundup, over 12 research items was felt for each give. BMO previously considering a nice incentive all the way to $3,five-hundred after you open BMO Dating As well as Currency Industry account and you may satisfied certain items.

Whenever she actually is perhaps not creating, there are their experimenting with an alternative karaoke put otherwise planning the girl 2nd travel abroad. The banks noted on this page have an educated indication-right up bonuses. It’s ultimately your choice to choose exactly how many bank accounts are working best for your role. Banking companies really worth gooey depositors because they’re less likely to disperse their funds to once they open a free account.

Because the also offers are often marketed, they’re fairly very easy to locate by searching the name from a bank checking account plus the phrase bonus. That it bank account bonus is perfect for pupils looking for a good easy family savings who may have minimal charges and will be offering money back to the some orders. If you live in the South, Mid-Atlantic or Midwest, you’ll have the great things about financial personally and you can getting a good dollars prize. We like that membership provides an excellent $100 bad equilibrium barrier just in case you be considered. Truist You to Examining has relationship account according to your own shared monthly mediocre balance that provide benefits based on the height. It added bonus benefits you to own strengthening a cost savings routine; the brand new bank account also offers a powerful interest rate as well as the credit union is simple to join.

Banks that when competed for new accounts by elevating their rates can get change to playing with bank incentives because the a tactic to draw clients without having to pay large prices long lasting. You’ll discover their advice bonus within two business days away from appointment the needs. You’ll find a bank sign-right up extra from the comparing banking companies otherwise profile you’re trying to find and you can looking out to possess marketing and advertising profiles adverts now offers.

Look for much more about our editorial advice and our things and you can functions remark methodology. To begin with an entrepreneur, she dependent our home home furniture merchandising brand, Combination House. Her mission to reach monetary liberty early is you can thanks to the prosperity of the woman shopping organization and you can assets in the a house. Try to statement all you secure alongside your own normal money on your taxation, therefore you should believe exactly how this might apply to your revenue.

We’ll update this site whenever we understand productive currency field membership incentives. I wear’t like that so it bonus will need up to 150 days to be deposited into your account. In addition to, so it added bonus give is only for sale in Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Iowa, Kentucky, Louisiana, Mississippi, Missouri, New york, Sc, Tennessee, and you can Tx. Which financial incentive is the best for those who like old-fashioned stone-and-mortar banking and want to bank somewhere that gives an extensive array of services.

Compared to similar also provides to your our very own list, you’ll rating a large bonus weighed against the newest head put specifications. You can make the full Savings account incentive because of the fulfilling an excellent minimal direct deposit demands within this ninety days. Lender advertisements fundamentally incorporate bucks incentives when you unlock an excellent the brand new checking or family savings. To qualify for that one-go out perk, you’ll have likely to set up head put to your bank and keep the brand new membership open for around two months. When you are there are many different signal-up incentives for brand new profile available to choose from, only a few is actually convenient. We’ve circular within the finest advertisements readily available, as well as the greatest lender incentives to you depends upon your unique economic desires and condition.

For individuals who’lso are currently opening a new account, it doesn’t take long discover now offers and you will evaluate a few sign-up bonuses to determine what of them you could potentially qualify for. A great guideline is always to features one checking account plus one bank account. This can give you the possibility to spend less whilst accessing finance to possess relaxed expenses. Dependent on your goals, you can even open extra savings account. High interest rates have been used to draw clients within the the past few years, but the Provided speed is anticipated to fall after this season.

Several of financial incentives need you to dive thanks to certain hoops to get the dollars, plus the big the bonus, more hoops you’re gonna encounter. Investigate provide’s terms and conditions meticulously—and also at the very least double—to make certain you realize all the criteria. This can increase the chance you’ll discovered your own extra on time, which means you obtained’t become scratching the head in a few days wondering in which those funds ran. Various banking companies and you will borrowing unions give bucks signal-upwards bonuses to have opening an alternative account.

The new savings account extra try nice in contrast to the fresh put needs, particularly when loaded against comparable offers on the the checklist. The newest Chase checking users delight in a great $300 added bonus once you unlock a great Pursue Full Family savings and you may create direct places totaling $five-hundred or maybe more inside 90 days from voucher enrollment. SoFi have tiered bonuses, to help you however earn an incentive even although you don’t qualify for the greatest amount. If you wear’t qualify for the newest $300 bonus give, you can earn an inferior $fifty extra with $step 1,000 to $4,999.99 directly in deposits. That it account in addition to will pay an aggressive to cuatro.60percent APY possesses no charge.

Earn $200 when you deposit $ten,100000 or higher in the the new currency in this 20 times of membership opening, next care for a balance with a minimum of $10,000 to own 90 days on the day the new deposit requirements is actually first fulfilled. However, an advantage isn’t well worth bringing stuck to the incorrect bank account or that have to help you scramble to meet conditions. In the event the a deal is attached to an underwhelming account or means one to create in initial deposit you could’t afford, you’re also better off signing up with another lender in the long term.

A lender sign-upwards extra are a monetary bonus provided by banking companies and you may credit unions in order to encourage people to discover a new membership. For an advantage, you’ll constantly have to both fulfill the absolute minimum deposit requirements or discovered qualifying lead deposits. The total Checking financial bonus is among the best offered bank account extra also provides readily available.

Gambling establishment Bonusları Hakkında Sonuç ve Oyuncu İncelemeleri

The new rating formulas take into account numerous investigation items for each economic device and you may service. We believe group will be able to generate monetary behavior that have rely on.

It payment get effect exactly how and you can where issues show up on that it website. We are not a comparison-device that also provides do not show all the offered deposit, funding, loan or credit items. Depending on the financial institution, starting a bank checking account takes any where from a couple of minutes to many weeks. Secure $3 hundred after you open an alternative Chase Business Complete Bank account. For brand new Pursue team examining customers with being qualified items. An educated financial signal-up bonuses is earn you many if you don’t several thousand dollars for individuals who be considered.

It added bonus offer is unique as it advantages your to possess beginning (and you will head depositing to your) your selection of family savings during the one of the primary banks on the U.S. You could like to try and secure so it extra that have one to of about three various other profile. Which lender bonus are shorter plus the added bonus requires expanded so you can be paid compared with other also offers for the all of our listing, however, requirements are simple. Here are the home elevators NerdWallet’s favourite lender indication-upwards bonuses which day, including the better checking account also provides and also the best family savings bonuses. Specific financial institutions provides looser laws and regulations than others to own savings account campaigns and you will checking account also provides; we’ve in depth the individuals standards below. Observe that only a few points otherwise offers come in all of the countries.

Check out the information about these proposes to greatest know very well what’s right for you. SoFi’s checking and bank account doesn’t have month-to-month costs otherwise overdraft fees. You’ll secure a great cuatro.60percent APY on your own deals equilibrium, and you will direct deposits struck the bank account to two days early. You can even earn as much as 15percent cashback to your SoFi debit card sales. You can make a great $300 added bonus when you open a Pursue Overall Family savings and you may establish head dumps totaling $500 or more inside 3 months. You’ll have the extra within this 15 days of acquiring a qualifying direct put.

Extremely banking companies still send campaigns thru email, and frequently such mailers provide directed incentives one spend more the brand new in public areas claimed of those. Of numerous banks enable you to make an application for a bank account on line, although some antique banks and you can credit unions might need you to definitely go to a local branch to arrange a merchant account. Signing up for a checking account is straightforward, nevertheless the process can differ with respect to the standard bank.

To find out if they’s worthwhile to you personally, comment one terms and conditions connected, on the extra provide. And, imagine you’ll need to keep up with the account for a lengthy period to gather the new added bonus. For many who’re also looking a bank account you can utilize long term, create a list of profile one meet your needs basic, after which do some searches to see if any of them have to offer the brand new account incentives.

In the Summer, the brand new Government Set-aside announced it could perhaps not raise the federal money rates (the speed and therefore industrial banks use to borrow and give currency together). Ahead of these most recent breaks, the brand new Given had improved the pace eleven times in 2 ages. So you might take advantage of one another a bank extra and you will large APYs inside the a new checking account. Don’t let tempting also offers distract you from the very first factors away from a checking account, such fees, minimums and advantages. Avoid depending on financial bonuses as the a way to obtain money whenever cash is rigid—you may not receive the bucks to possess days once opening. An earlier bonus provided the fresh examining customers the opportunity to secure a good $2 hundred Pursue bank account bonus because of the starting a whole Savings account and conference criteria.

Among the best checking account advertisements currently available is actually for TD Effortless Discounts. For those who’re also looking for a new savings account, consider checking to possess bank incentives basic. However, ensure you can meet all of the extra conditions, so you actually have the claimed bucks. For individuals who wouldn’t normally discover a free account with a financial but they has a rising bonus provide, it may be far better look elsewhere.

Should i convey more than simply you to examining otherwise family savings?

I unearthed that the underlying membership linked with so it campaign are equally as good as the main benefit in itself, so it is one of the better picks to own beginning a different membership. We love one Citi Checking have most other incentive possibilities for individuals who reduce to help you put. For many who wear’t provides at the least $3 hundred,100 in order to deposit, you can earn a $step one,five hundred added bonus with $2 hundred,100 in order to $299,999 or $five-hundred which have $30,100 in order to $199,999 in the dumps. Secure a great $a hundred bonus once you deposit $a hundred thirty days to have 12 months that have Alliant’s Best Possibility Family savings.

Delight in to a good $3,100 bonus when you open another Chase Private Buyer Examining℠ account which have being qualified issues. Inside forty five days of discount registration, import qualifying the newest currency otherwise securities to help you a mixture of qualified examining, deals and you can/or J.P. Maintain your the fresh money for 90 days from voucher registration and you may enjoy their extra. Some funds industry accounts has bank incentives, even when it’lso are less preferred because the examining and you may family savings incentives.

Banking institutions and you will borrowing unions offer bonuses to own starting membership to draw new clients. A plus get draw in individuals like a certain lender more than someone else they’re also considering starting a banking matchmaking it or even might not have. If new customers care for their profile, generate deposits and you will shell out membership charges, the financial institution can make back the cash they allocated to bonuses. We chose the new Truist Financial added bonus as the finest strategy when the you’re trying to find easy standards. It regional financial’s extra has only a $500 head put requirements, and you have 90 days to do it. As the idea of getting paid back to open up a new lender membership is of interest, being qualified to have a lender incentive isn’t usually a sufficient reasoning—naturally—to alter banking companies.

Choices to choose from were LifeGreen Checking, LifeGreen Preferred Examining, LifeGreen eAccess Account and 62+ LifeGreen Checking. A direct put is an electronic put you get from the employer, government entities otherwise an advantages merchant. You’ll discover their extra within this seven working days once the direct deposit windows shuts.

You can find an educated possibilities readily available by considering the set of a knowledgeable lender bonuses and you will advertisements, current month-to-month. Which give makes you prefer a bank account that actually works best for you — of very first (with no lowest harmony needs) to several amounts of premium. You can earn dollars insurance firms lead deposits you to definitely satisfy an excellent minimum demands. It incentive provide makes you secure a cash extra having your choice of possibly a new combination checking-and-checking account otherwise a new savings account simply. Compared with almost every other also offers for the very same profile on the our checklist, this one also offers a added bonus amount for a reduced lowest deposit.